mass tax connect estimated tax payment

Access account information 24 hours a day 7 days a week. ONLINE MASS DOR TAX PAYMENT PROCESS STEP 1.

How To Register File Taxes Online In Massachusetts

How To Pay Estimated Taxes.

. Do more with MassTaxConnect. Mass tax connect make estimated payment Thursday June 23 2022 Edit. With a MassTaxConnect account you can.

Read on for a step by step guide on making tax payments in MA. Your support ID is. Your support ID is.

You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app. Your support ID is. You need the following information to create your MassTaxConnect account.

Crediting an overpayment on your 2020 return to your 2021 estimated tax. Please enable JavaScript to view the page content. Corporate Taxes DOR E-file Personal Taxes Sales Tax Payments Tax Tips Taxes Videos YouTube.

The Massachusetts Department of Revenue DOR replaced their existing e-filing system WebFile. Please enable JavaScript to view the page content. The document makes clear that it begins with the credits required to be issued for the fiscal year ending June 30 2022 First DOR will calculate the excess revenue percentage.

Confirm the payment request information. Keep an eye out on our ever-changing frequently updated FAQ page on massgovdor. Submit and amend most tax returns.

Keep the payment confirmation for your records. Final Results _____ Total Estimated Tax For This Year. Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth.

With MassTaxConnect you can. Download or print the 2021 Massachusetts Form 355-ES Corporate Estimated Tax Payment Vouchers for FREE from the Massachusetts Department of Revenue. Please enable JavaScript to view the page content.

Download or print the 2021 Massachusetts Form 1-ES Estimated Income Tax Payment Vouchers for FREE from the Massachusetts Department of Revenue. Please Enter 2021 Overpayment Amount. Set up a payment agreement If you owe 5000 or less Request a Certificate of Good Standing andor Corporate.

E-filing is the fastest way to file your Massachusetts personal income tax return and get your refund from DOR. Cozbycpa 2021-03-22T125645-0400 March 22nd 2021 Categories. Learn what e-filing and payment options are available and what.

As a partner you can pay the estimated tax by. Select Payment Type choose Return Payment for year 2019 if paying the balance. Use this link to log into Mass Depa.

Under Payment Type select Estimated payment. Please Enter 2022 MA Withholding Amount. Please enable JavaScript to view the page content.

Your Social Security number SSN or Individual Taxpayer Identification Number ITIN and. Your support ID is. How do I pay estimated taxes for 2021.

Your Tax Amount is Less Than 400. Make bill payments return payments.

Solved How Do You Categorize An Estimated Tax Payment On Qb I Know It S Not An Expense What Is It

How To Start An Llc In Massachusetts For 49 Ma Llc Formation Zenbusiness Inc

Massachusetts Income Tax H R Block

Massachusetts Rhode Island Natp Chapter Making 2018 Estimated Payments For Individual Taxpayers On Masstaxconnect

H R Block 2022 Tax Year 2021 Review Pcmag

Klr Massachusetts Residents Here S How To Pay Taxes Through

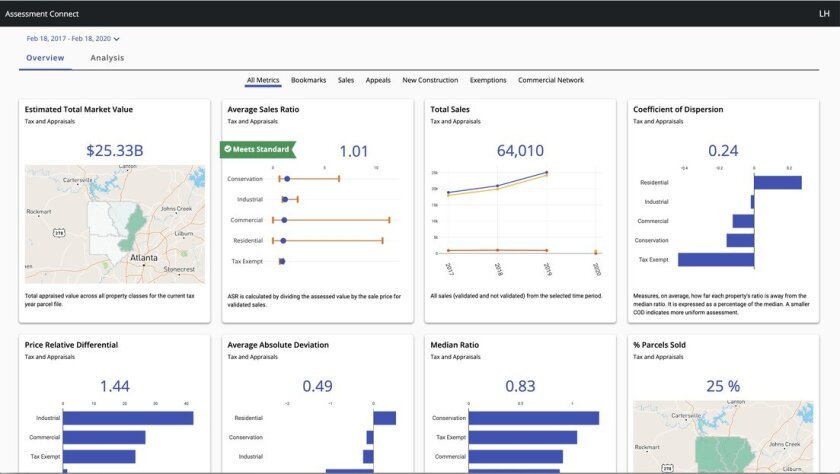

New Tyler Product Meant To Speed Property Value Analysis

Final Annual Estimated Tax Payment Due Jan 15 Don T Mess With Taxes

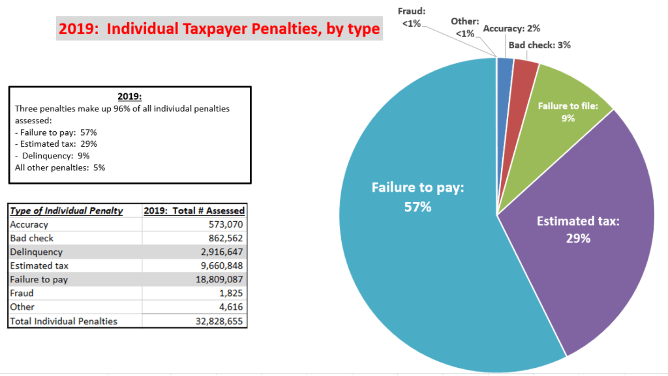

Do S And Don Ts When Requesting Irs Penalty Abatement For Failure To File Or Pay Penalties Jackson Hewitt

How To Make Ma Dor Income Tax Payments Online The Onaway

Here S How Much Money You Could Get Back Through The New Mass Tax Refund The Boston Globe

Estimated Tax Payments How They Work And When To Pay Them Bankrate

3 Billion Mass Tax Surplus Being Returned To Taxpayers Nbc Boston

Masstaxconnect Resources Mass Gov

Millions Of Mass Taxpayers Will Get Money Back Starting In November Officials Say Here Are The Details The Boston Globe

Instructions For Preparing Form F 1120 For 2008 Tax Year R 01 09