are inherited annuity payments taxable

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. The funds in an annuity can grow tax-deferred until you decide to withdraw the untaxed portion.

Annuity Beneficiaries Inheriting An Annuity After Death

Youd have to pay any taxes due on the benefits at the time you receive them.

. As a result inherited annuities are subject to tax. Inherited Annuity Tax Implications. At the time you receive the benefits youll have to pay any taxes that are payable.

Ad Learn More about How Annuities Work from Fidelity. Ad Learn More about How Annuities Work from Fidelity. You could opt to take any money remaining in an inherited annuity in one lump sum.

The part of the annuity payment representing return of capital is not taxable but the earnings are. Ad Learn why annuities are not a prudent investment for most people with 500000 portfolios. Typically all inheritable qualified annuities usually IRA annuities are subject to income taxes 100 of the assets.

Is an inherited annuity taxed as ordinary income. If you are inheriting a non qualified annuity the earnings are taxed as ordinary. IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would.

How much tax do you pay on an inherited annuity. Consider the case where you. Because the owner never paid any taxes on the.

For an annuity with a large untaxed gain that could mean that a lot of the money would go to pay state and federal income taxes. Inherited annuities are taxable as income. Thats because no taxes have been paid on that money.

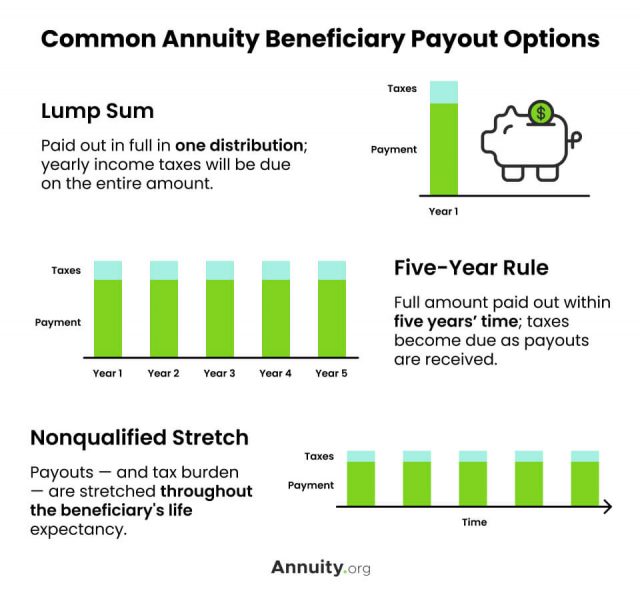

Tax-deferred annuity beneficiaries can pick from a variety of payment alternatives that will affect how the income benefit is taxed. Inheritance Taxes on Annuity Benefits Pre-tax dollars are used to fund qualifying annuities. The date of the tax event is determined on the payout structure and your beneficiary status.

Any beneficiary including spouses can choose to take a one-time lump sum payout. Fisher Investments warns retirees about annuities. The inherited annuitys remaining funds can be withdrawn in a single payment if desired.

This is a problem only for non-spouse beneficiaries. The beneficiary of a tax-deferred annuity may choose from several payout options which will determine how the income benefit will be taxed. The payments received from an annuity are treated as ordinary income which could be as high as a 37 marginal tax rate depending on your tax bracket.

Once the money is inside of an annuity it grows tax-free or rather tax-deferred so the policyholder does not have to pay taxes on the growing account. At the time you receive the benefits youll have to pay any taxes that are. In this case taxes are owed on the entire difference between what the original owner paid for the.

Inherited annuities like any other sort of income are taxable. It is possible to pay. But annuities purchased with a Roth.

The payments received from an annuity are treated as ordinary income which could be as high as a 37 marginal tax rate depending on. You have the option of taking a lump sum payment from an inherited annuity if there is any money left over. When you receive payments from a qualified annuity those payments are fully taxable as income.

Inherited Annuity Tax Guide For Beneficiaries

How Nris Can Repatriate Pension To The Us From India Pensions Chartered Accountant Canning

Understanding Annuities And Taxes Mistakes People Make Due

Annuity Taxation How Various Annuities Are Taxed

Is An Annuity Death Benefit Taxable Safemoney Com

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Annuity Taxation How Various Annuities Are Taxed

Annuity Beneficiaries Inheriting An Annuity After Death

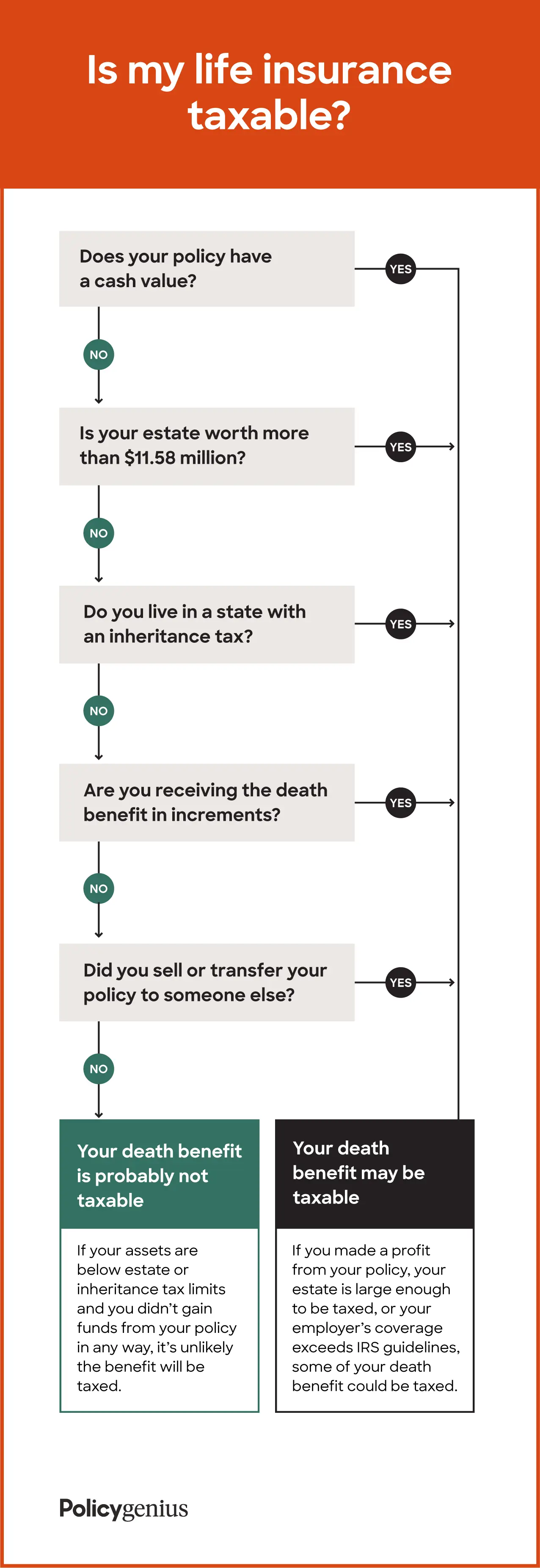

Is Life Insurance Taxable Policygenius

Tax Troubles With Annuities Ann Arbor Investment Management Vintage Financial Services

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

Is Your Inheritance Considered Taxable Income H R Block

Annuity Exclusion Ratio What It Is And How It Works

What Uk Tax Do I Pay On My Overseas Pension Low Incomes Tax Reform Group

How Are Annuities Taxed For Retirement The Annuity Expert

Is Life Insurance Taxable Forbes Advisor